Financial OverviewThere may be discrepancies in the amount due to rounding of individual digits.

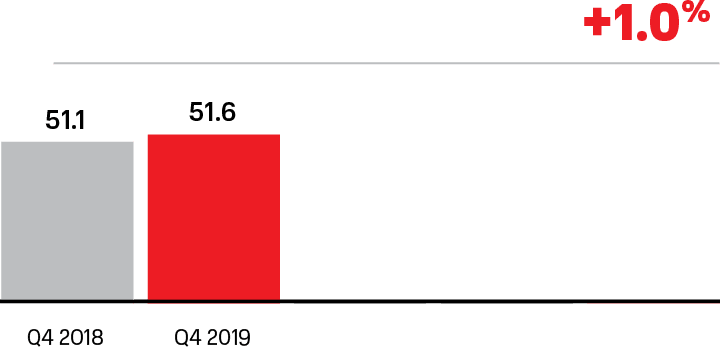

I am pleased to note that in Q4 we maintained the momentum of the first nine months of the year and crossed the finish line of 2019 with good dynamics of key indicators. The total quarterly revenue of the Group, taking into account the deconsolidation of the results of the former MTS subsidiary in Ukraine, increased by 4.1% compared to the same period last year and reached 127.1 billion rubles. We attribute the increase in revenue to the increase in the number of connections in Russia and the consumption of fintech products and services of MTS Bank. The adjusted OIBDA in Q4 increased by 1% compared to the same period last year to 51.6 billion rubles. We set clear strategic goals for the future: to strengthen leadership in the field of communication services, while opening up new opportunities for business growth through digital products. We have everything to succeed in one of the most productive local markets and meet the expectations of shareholders: a leadership position, a strong brand, and a highly professional team.Aleksey Kornya, President of MTS

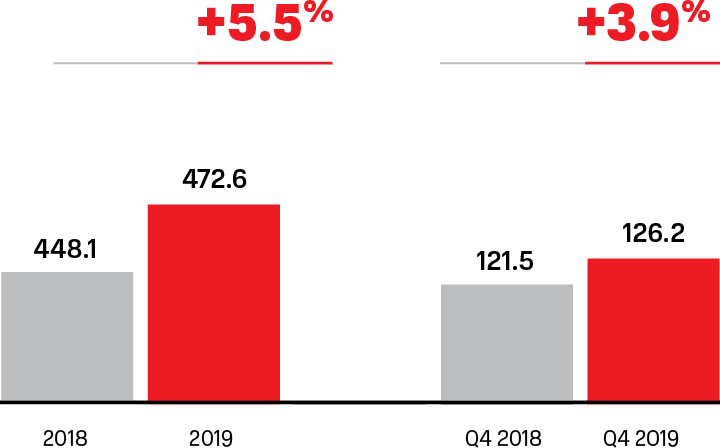

Data for 2018 and 2019 are given taking into account the deconsolidation of the results of the former MTS subsidiary in Ukraine.

Positive results of MTS Group in 2019 due to:

- Growth in subscriber base and mobile revenue in Russia.

- Growth in consumption of fintech products, MTS Bank services, as well as other digital services: Cloud, 1oT and system integration.

Revenues for the full year of 2019 increased by 5.5% compared with the figures for 2018 to 476.1 billion rubles, taking into account the deconsolidation of the results of the former MTS subsidiary in Ukraine. The result is due to both steady growth in the basic telecommunications market and the contribution from related areas, including financial services, system integration, and software sales. The level of growing indicators is partially adjusted by a slight decrease in revenue from sales of phones and accessories. The contribution from MTS Bank’s indicators for the whole year cannot be compared, since the Bank’s consolidation occurred in the second half of 2018; however, in the second half of 2019, the Bank’s revenue increased by 40.8% compared to the same period last year, and this reflects the Company’s strategy for the growth of financial services penetration into the subscriber base.Andrey Kamensky, MTS Management Board Member, Vice President for Finance

The growth of the adjusted OIBDA of the Group is due to:

- Strong results in Russia.

- Positive dynamics of this indicator in the target markets against the background of increased use of data transfer, financial services, and other digital services: Cloud, IoT and system integration.

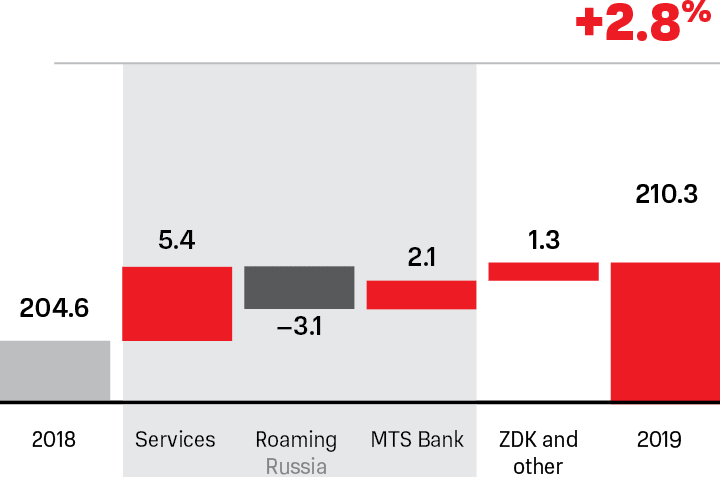

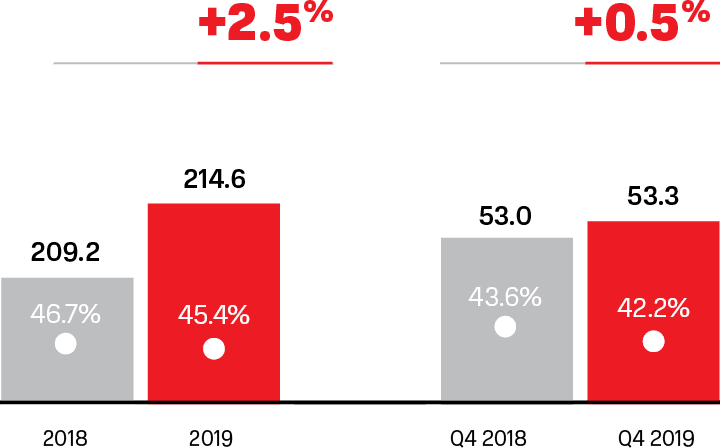

The adjusted OIBDA of the Group in Q4 increased by 1% compared to the same period in 2018 to 51.6 billion rubles. The adjusted OIBDA for the full year of 2019 increased by 2.8% to 210.3 billion rubles: the growth in revenue from the mobile business offset the negative impact of the cancellation of intranet roaming. Adjusted OIBDA margin was 44.2% for fiscal year 2019.Andrey Kamensky, MTS Management Board Member, Vice President for Finance

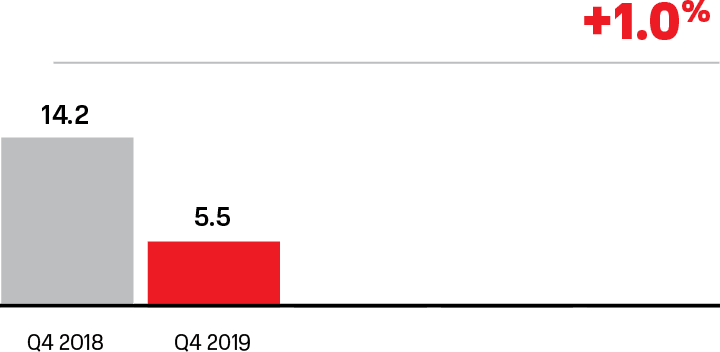

The dynamic of net profit in the fourth quarter of 2019 was affected, on the one hand, by high operating indicators, and, on the other hand, by higher interest expenses, the result of regular operations with derivatives, and non-monetary losses from the sale of assets..

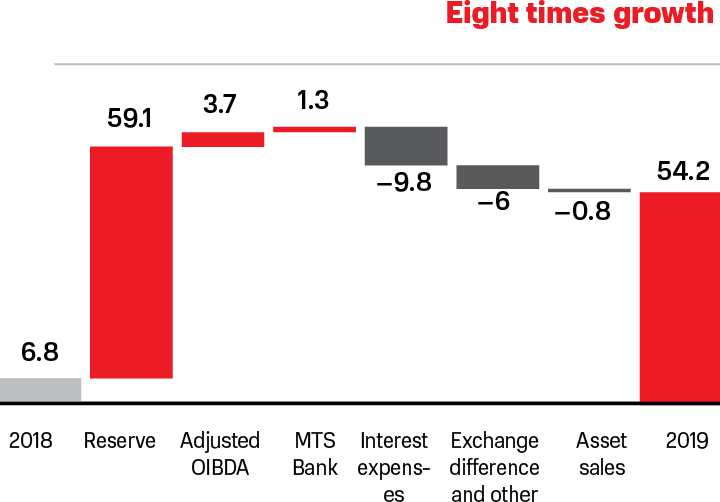

Net profit for the full year of 2019 increased eight times compared to 2018 up to 54.2 billion rubles. Data for 2018 reflects MTS reserve accrual of 850 million US dollars under a settlement agreement with the Securities and Exchange Commission (SEC) and the U.S. Department of Justice (DOJ). The positive dynamics of net profit was negatively affected by the growth of debt servicing expenses, the result of regular operations with derivatives, and non-monetary losses from the sale of assets.Andrey Kamensky, MTS Management Board Member, Vice President for Finance

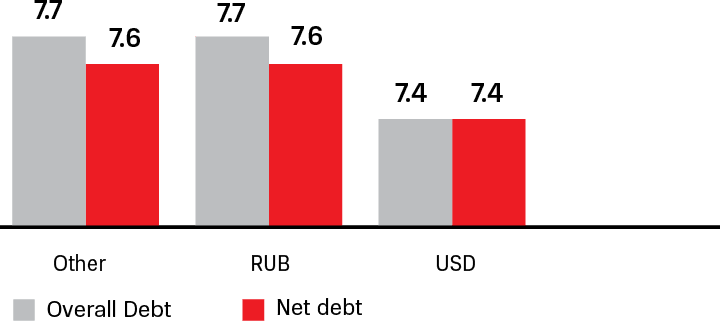

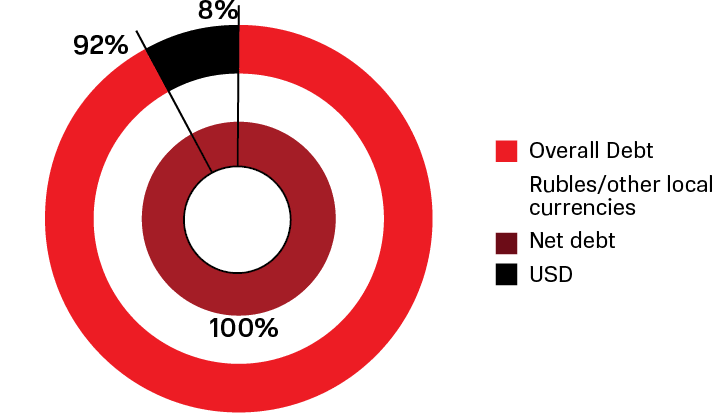

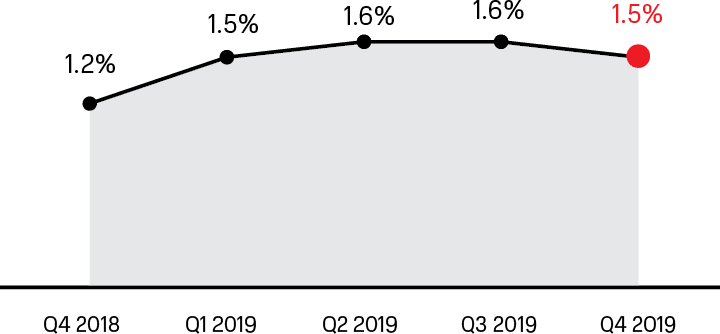

at the end of the fourth quarter of 2019Figures are indicated without leasing obligations as of December 31, 2019.

Net debt of the Group Without expenses for fundraising as of December 31, 2019.

- The ratio of net debt to LTM of adjusted OIBDA decreased to 1.5x. This is a comfortable level that allows us to maintain financial stability and the company’s ability to maintain both the level of investment and high profitability for shareholders.

- In the fourth quarter of 2019, MTS reduced the weighted average interest rates of debt to 7.7 from 7.8 percent in the third quarter of 2019 due to the optimization of the debt portfolio.

In the fourth quarter of 2019, MTS Group:

- Built 5.1 thousand stations in 78 regions of Russia, including 3.7 thousand 4G .

- LTE network coverage in Russia is 74 percent.

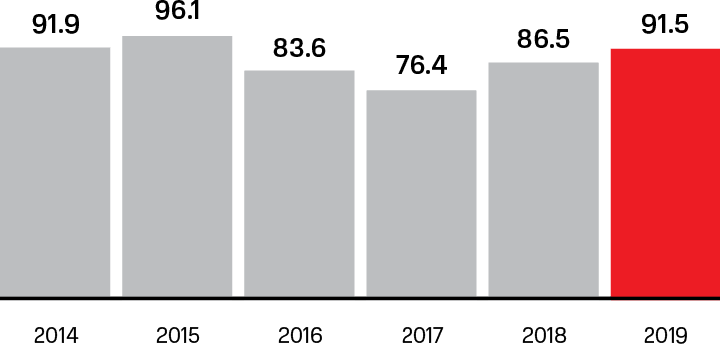

MTS Group’s capital expenditures for 2019 reached 91.5 billion rubles; in Russia, the ratio of capital expenditures to revenue amounted to 17.3%. The Company continued to invest heavily in the development of our telecommunications infrastructure with a focus on improving coverage and communication quality for consumers.Andrey Kamensky, MTS Management Board Member, Vice President for Finance

| 2019 | 2018 | |||

|---|---|---|---|---|

| Capital expenditures | As % of income | Capital expenditures | As % of income | |

| Russia | 81.8 | 17.3% | 75.1 | 16.8% |

| Ukraine Without costs in amount of 5.5 billion rubles related to 4G license purchase in Ukraine in 2018 | 8.2 | 22.3% | 9.3 | 31.4% |

| Armenia Without costs in amount of 0.3 billion rubles related to 4G license purchases in Armenia in 2019 | 1.5 | 19.7% | 2.0 | 26.4% |

| Group | 91.5 | N/A | 86.5 | N/A |

| Q4 2019 | Q4 2018 | Change, % | |

|---|---|---|---|

| Russia | 79.1 | 78.0 | 1.4% |

| Armenia | 2.2 | 2.1 | 3.7% |

| Belarus MTS owns a 49% stake in MTS JLLC in Belarus, which is not consolidated. | 5.6 | 5.5 | 2.9% |

- Growth in connection rate in Russia.

- Growth of subscriber base in Belarus and Armenia against the background of mobile data transfer services development.

RUSSIA

Financial and operating results

Revenue in Russia in Q4 2019 increased by 3.9% compared to the same period last year to 126.2 billion rubles. The growth is largely due to the high performance of MTS Bank, as well as the growth of revenue from mobile services.

In Q4 2019, the adjusted OIBDA increased by 0.5% compared to the same period last year, reaching 53.3 billion rubles, reflecting the dynamics of revenue. In Q4 2019, the adjusted OIBDA margin in Russia amounted to 42.2%.

Andrey Kamensky, Management Board Member, Vice President for Finance

Revenue growth in Russia due to:

- Increased consumption of mobile internet services.

- MTS Bank’s contribution to total revenue.

- Sales growth of cloud services, products based on the Internet of Things technology and system integration.

Growth of adjusted OIBDA in Russia following the growth rate of revenue.

Against the backdrop of improving market conditions, revenue from MTS mobile business in Russia in Q4 grew by 3.3% compared to the same period last year to 81.8 billion rubles. The growth in revenue from mobile services also reflects a weakening regulatory pressure compared to the previous year.

The subscriber base increased by 1.4% year-on-year to 79.1 million subscribers at the end of Q4 2019.

Revenue from fixed businesses in Russia slightly decreased compared to the same period last year – by 1.5% to 15 billion rubles.

| Q4 2019 | Q4 2018 | Change, % | |

|---|---|---|---|

| Total | 15.0 | 15.3 | −1.5 |

| B2C | 7.7 | 7.7 | 0.7 |

| B2B + B2G + B2O | 7.3 | 7.6 | −3.8 |

According to MTS’ own assessment, at the end of Q4 2019, the share of the Company in the mass market of broadband access B2C in Moscow increased up to 42%, and the share of the pay-TV market grew to 45.5%. The number of users of GPON networks continued to grow: the number of subscribers in the mass and business markets reached 2.1 million.

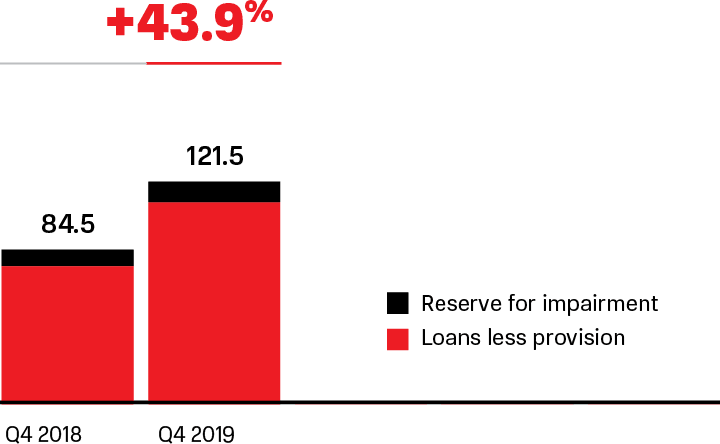

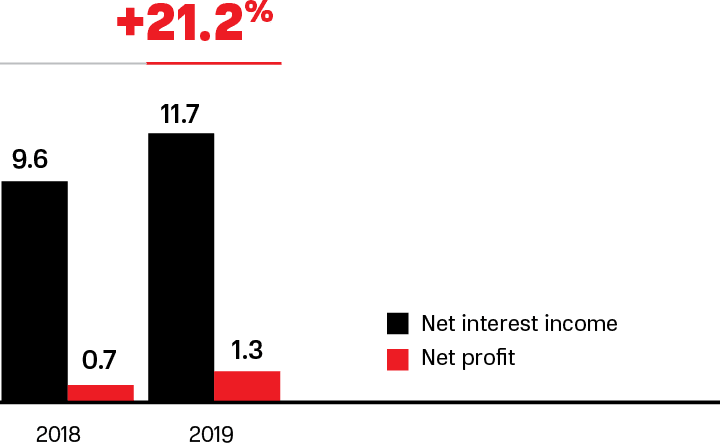

MTS Bank’s contribution to the Group’s total revenue in Q4 2019 reached 9 billion rubles, showing an increase of 43.5% year on year. The growth was due to an increase in the volume of retail loans issued, including with the use of Big Data analytics for scoring and risk assessment.

Revenue from MTS system integration services for 2019 increased by 39.2% compared to the same period last year to 10.3 billion rubles.

Revenues from other lines of business, including e-sports and ticket services, also showed significant growth: by 20.5% year-on-year to 1.5 billion rubles.

Revenues from the sale of goods in Q4 remained stable at the level of the previous year and reached 21.7 billion rubles, showing an increase of 0.2%. The increase in revenue from big software orders offsets the decline in sales of phones and accessories.

Retail chain revenue remained stable, slightly decreasing by 1.6% to 58.9 billion rubles as a result of MTS’ efforts to optimize the retail network in the second half of 2019.

By the end of 2019, the penetration of smartphones in the MTS network reached 74.5%, and the penetration of the mobile internet through the base increased to 62.9%.

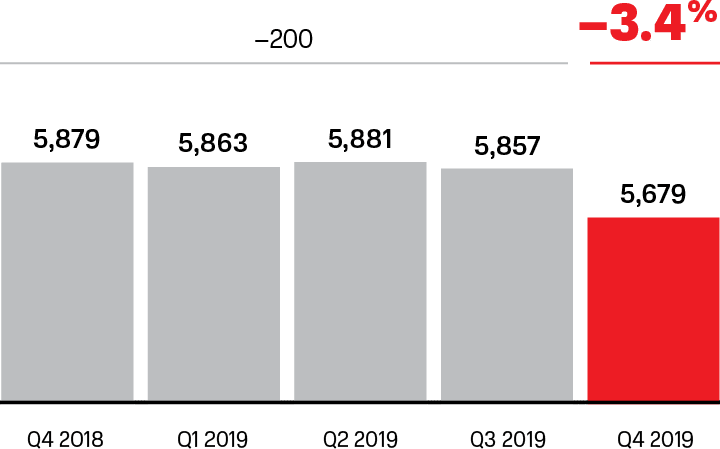

In accordance with a strategy aimed at optimizing the retail presence of MTS, the Company closed 202 outlets in the second half of 2019. At the end of 2019, the MTS retail chain included 5,679 stores. Revenue from online sales grew by 33.1% year-on-year and amounted to 2.7 billion rubles in Q4 2019.

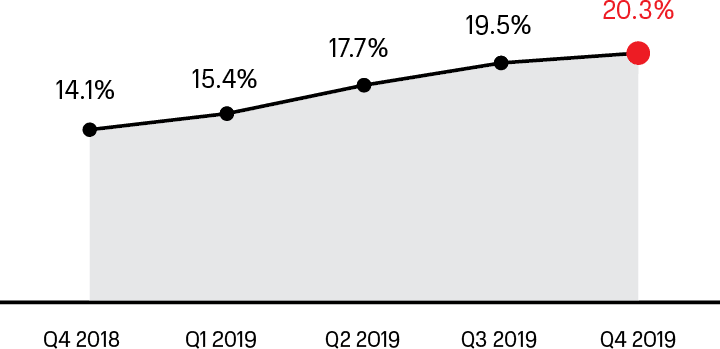

MTS continued to develop the My MTS self-service application, which is the center of the user ecosystem of digital services. By the end of 2019, the number of users per month reached 20.3 million .

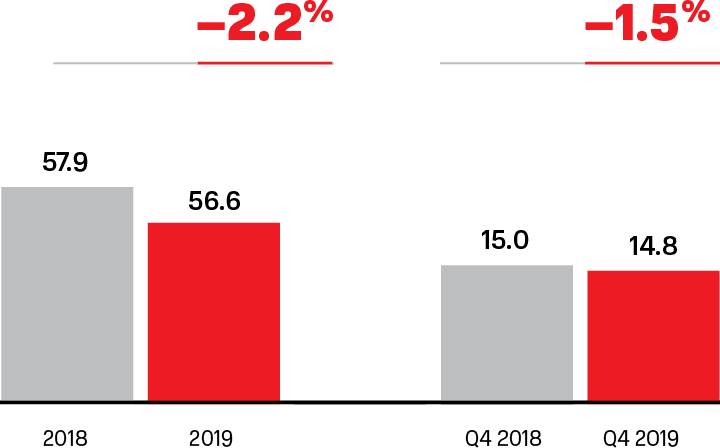

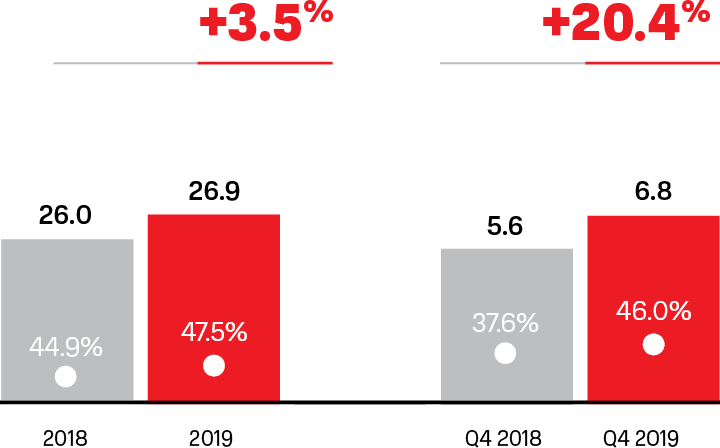

Armenia

In Armenia, in Q4 2019, revenue decreased by 1.5% year-on-year to 14.8 billion drams. The revenue was negatively impacted by lower tariffs for interconnects and a continuing decline in voice service revenues. At the same time, OIBDA showed positive dynamics, increasing by 20.4% compared to the same period last year to 6.8 billion drams. Profitability increased by 8.4 pp to 46%.

Revenues for the full year of 2019 decreased by 2.2% to 56.6 billion drams compared to 2018. OIBDA for the year increased by 3.5% to 26.9 billion drams. OIBDA margin increased by 2.6 pp and reached 47.5%.

Andrey Kamensky, Management Board Member, Vice President for Finance

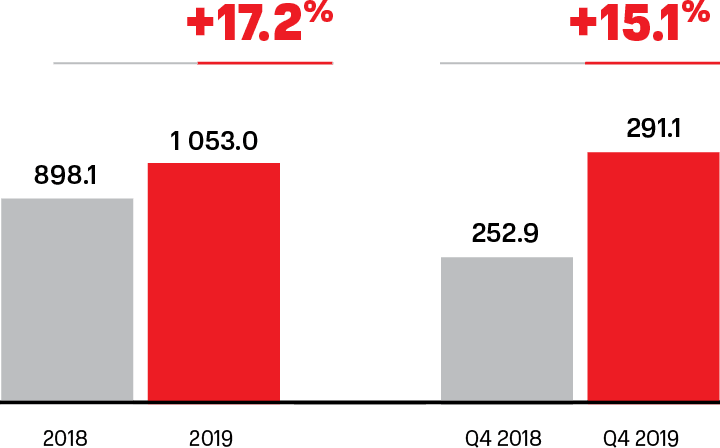

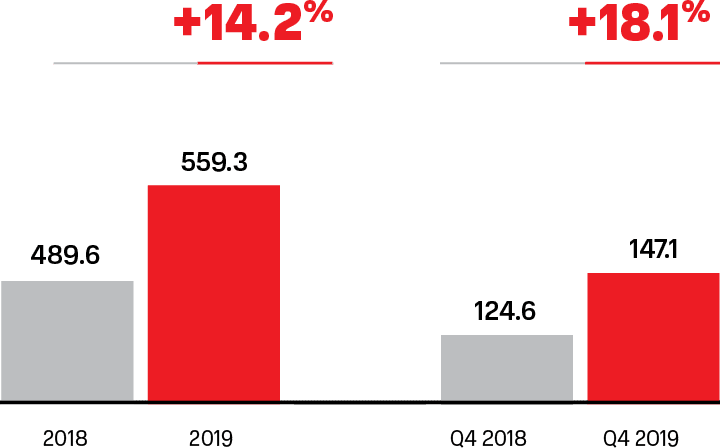

Belarus

In Belarus, MTS continues to show impressive double-digit growth in financial performance. Revenues in Q4 2019 increased by 15.1% year-on-year and reached 291.1 million Belarusian rubles. OIBDA also showed a significant increase of 18.1% compared to the previous quarter to 147.1 million Belarusian rubles. OIBDA margin was 50.5%.

For the full year 2019, revenue grew by 17.2% to 1,053 billion Belarusian rubles amid increased consumption of data services and growth in retail sales. OIBDA for the year significantly increased by 14.2% to 559.3 million Belarusian rubles, profitability amounted to 53.1%.

Andrey Kamensky, MTS Management Board Member, Vice President for Finance

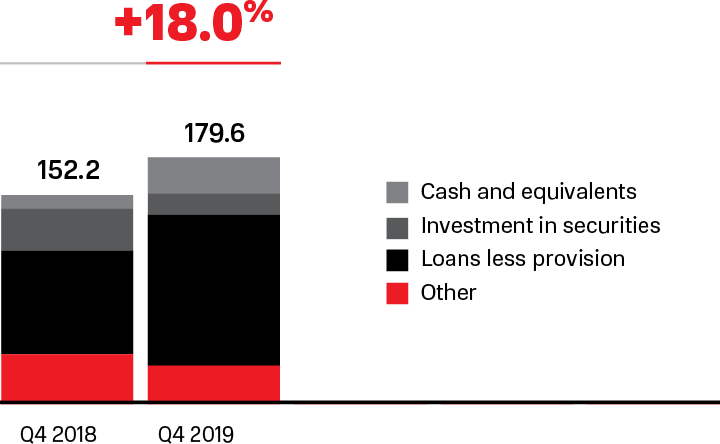

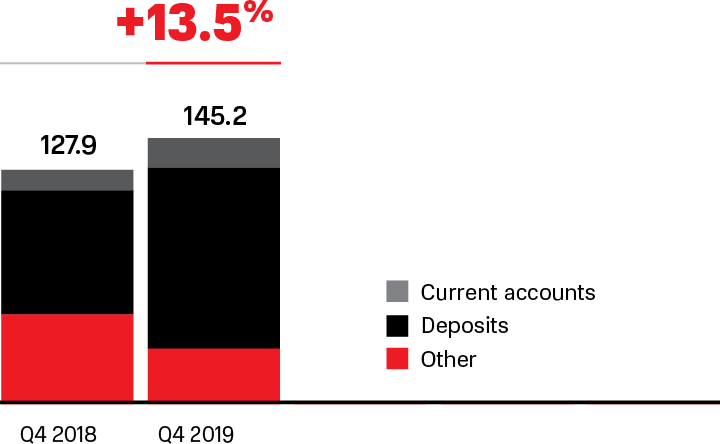

financial and operating results Consolidated data of MTS Group

retail loan portfolio

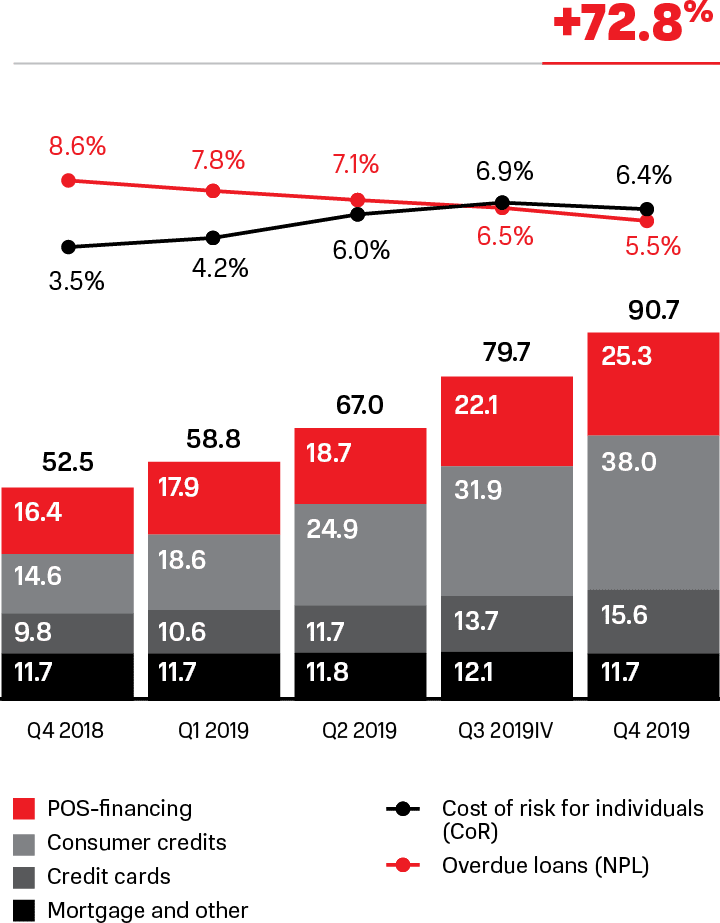

- In 2019, the volume of retail loans issued by MTS Bank increased by 73 percent.

- The total number of issued cards (credit and debit) increased in 2019 by 72% year-on-year to 1.14 million cards by integrating banking products into MTS applications and creating individual offers for MTS customers.

MTS forecasts three percent growth in the Group’s revenue in 2020, taking into account the following factors:

- stable competitive situation in Russia;

- positive dynamics of the cost of services;

- increased data-traffic volume with decreased level of voice-service use and improved penetration of services based on mobile internet;

- possible changes in the consumption of roaming services;

- macroeconomic and regulatory changes.

MTS predicts OIBDA for 2020 at the level of 2019, allowing for the possibility of slight growth, due to the following factors:

- consumer behavior and increased consumption of highly profitable products;

- decrease in sales of SIM cards and outflow;

- optimization of the Group’s retail network and associated costs;

- a one-time positive effect in Q4 2019;

- increasing staff costs in new areas of business;

- possible changes in the consumption of roaming services;

- macroeconomic and regulatory changes.

The forecast of the level of capital expenditures takes into account the following projects for investment:

- continued development of LTE networks;

- continued investments in the development of digital products;

- implementation of commercial 5G solutions in the Russian market;

- macroeconomic changes and currency volatility;

- implementation of projects on infrastructure and frequency-spectrum sharing with other operators in Russia.

Russian Telephone Company Joint Stock Company

Location: 5, Building 2, Vorontsovskaya St., 109147 Moscow, Russia

The share of MTS PJSC in the authorized capital of the affiliate%: 100

Primary business: sales of MTS PJSC services

Sole executive body: Galushko, Evgeny Pavlovich (authority terminated on 04.13.2020);

Belyakov, Sergey Sergeevich (took office on 04.14.2020)

Moscow City Telephone Network Public Joint Stock Company

Location: 25, Building 1, Bolshaya Ordynka St., 119017 Moscow, Russia

The share of MTS PJSC in the authorized capital of the affiliate, %: 99.159

The share of the affiliate in the authorized capital of MTS PJSC, %: 0,38

Primary business: provision of fixed-line communication services in the territory of Moscow

Sole executive body: Medvedev, Vladislav Aleksandrovich

MTS Bank Public Joint-Stock Company

Location: 18, Building 1, Pr-t Andropova, 115432 Moscow, Russia

The share of MTS PJSC in the authorized capital of the affiliate (indirect participation through subsidiary Mobile TeleSystems B.V. and MGTS PJSC), %: 99,74

Primary business: banking operations

Sole executive body: Ilya V. Filatov

Data on changed degree of control over a controlled legal entity of substantial value for the company

MTS Bank Public Joint-Stock Company

As of December 31, 2017, MTS Group owned 26.61% shares in MTS Bank PJSC.

In July 2018, MTS PJSC purchased from Sistema PJSFC 28.63% shares in MTS Bank PJSC, having increased the share up to 55.24%.

In February 2019, MTS Group increased the share of ownership of MTS Bank PJSC up to 94.72% by acquisition of 39.48% shares of MTS Bank PJSC from Sistema PJSFC.

No changes occurred in other affiliates for the reporting period.

Information on Significant Transactions of Affiliates

In the reporting period, RTC JSC and MTS Bank PJSC did not make such transactions.

Information on transactions is specified in Annex No. 2 to the Annual Report of MTS PJSC.

Credit agencies Fitch and Standard&Poor’s and RA Expert assigned the following ratings to the Company’s debentures.